If you’re wondering why so many Australians want to buy their own home and invest in property, consider this statistic from PEXA, the online property settlement platform.

Capital city property prices have increased by an average of 7.2% per annum over the past 50 years or so, according to PEXA.

And if you’ve been an investor during that time, you also would’ve collected rents along the way.

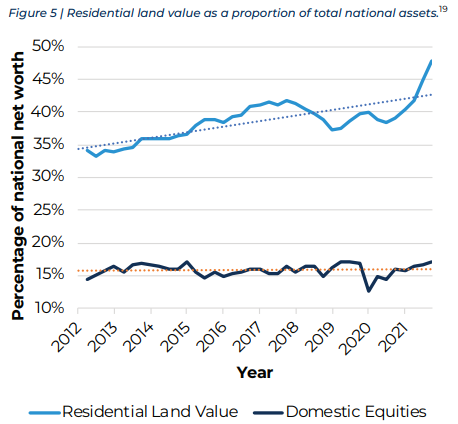

As the graph shows, residential land alone (not including the housing sitting on that land) now accounts for more than half of Australia’s national assets. Furthermore, the amount of wealth in the property market is much higher than the amount invested in shares (also known as equities).

During the May quarter, the number of potential buyers in the combined capital cities was 3.1% higher than the previous quarter and 15.0% higher than the year before.

PropTrack said that was probably due to:

- Very competitive rental markets (which is prompting some people to buy instead)

- Rising property prices

- High net overseas migration

- Low unemployment and rising wages

- Relatively few new properties being listed for sale

PropTrack has identified a sharp rise in property buyer activity, which it believes is being driven by five main factors.