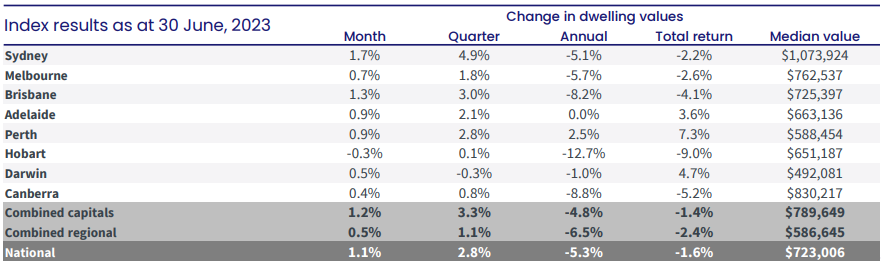

Australia’s median property price has now increased for four consecutive months, after rising another 1.1% in June, according to CoreLogic.

That means prices have risen 3.4% since the market bottomed out in February and are just 6.0% below their previous peak in April 2022.

CoreLogic research director Tim Lawless said the surge in demand is being driven by a lack of supply.

“Through June, the flow of new capital city listings was nearly 10% below the previous five-year average and total inventory levels are more than a quarter below average,” he said.

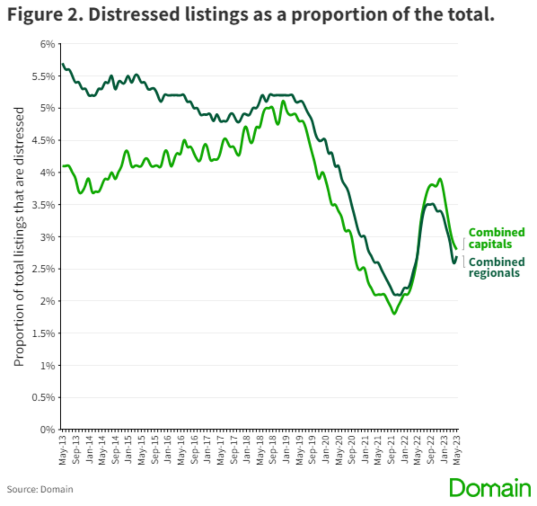

Distressed listings remain at low levels

Very few homeowners are being forced to sell their property, despite the rise in interest rates over the past year, according to Domain.

The share of distressed listings in May was just 2.8% across the combined capitals – compared to a record high of 5.1% in 2018.

For the combined regions, the share of distressed listings in May was 2.7%, compared to a high of 5.7% in 2013.

“The start of the pandemic witnessed a sharp decline in distressed listings due to mortgage holidays and savings buffers built up due to the extended lockdowns/border closures. The current low levels of distressed listings are a positive sign for the housing market,” according to Domain.