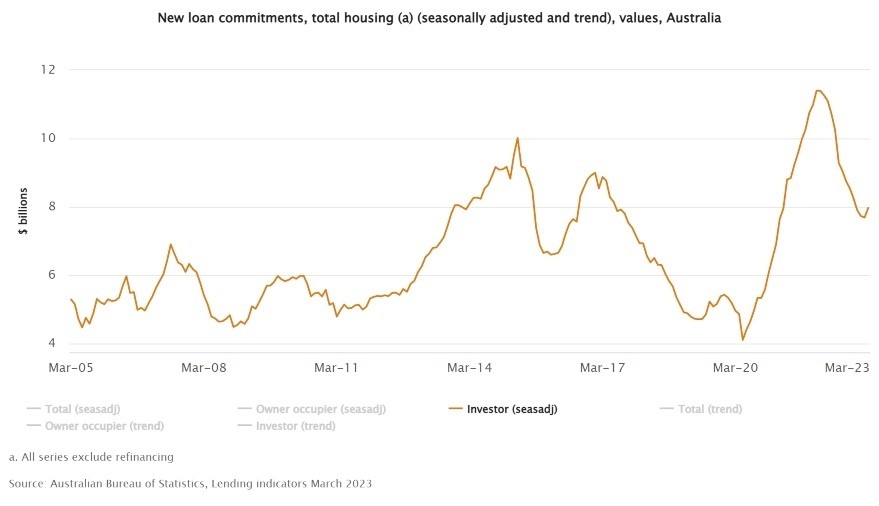

Property investor activity waxes and wanes, as we can see in this graph from the Australian Bureau of Statistics, which measures investor home loan commitments. But one thing that seems to remain consistent, according to the Australian Taxation Office (ATO), is that a lot of investors don’t report their income and expenses correctly.

According to the ATO:

* A review of tax returns from property investors found 90% contained mistakes

* You need to correctly apportion loan interest expenses if part of your investment home loan is used for other purposes (such as buying a car)

* Typically, you don’t have to pay capital gains tax when you sell your main residence – but if you use it to earn a rental income, such as by renting out a spare room through Airbnb, capital gains tax may apply

Property investment is a great way to build long-term wealth. If you need help with your taxes during your investment journey, consult an accountant.