The federal government’s Home Guarantee Scheme (HGS) is successfully helping first home buyers into the market, especially those on lower incomes, according to a new study by the National Housing Finance & Investment Corporation and Commonwealth Bank.

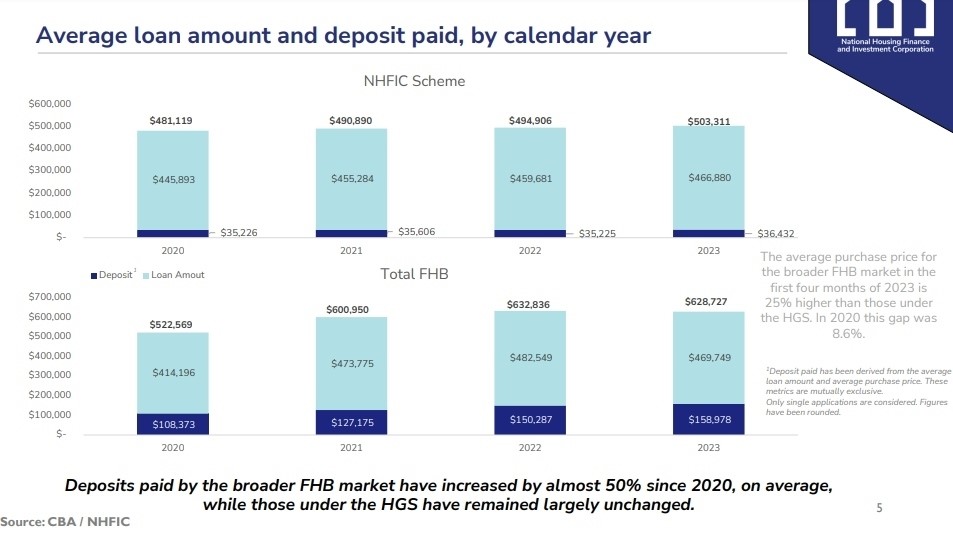

Since 2020, the average deposit by first home buyers using the HGS has barely changed, rising from $35,226 to $36,432, an increase of just 3.4%. But the average deposit required by the broader first home buyer market has jumped from $108,373 to $158,978, an increase of 46.7% (see image).

At the same time, households using the HGS tend to have a lower average income ($108,000) than the broader first home buyer market ($117,000).

Under the HGS, the government helps eligible first home buyers enter the market with just a 5% deposit, without needing to pay lender’s mortgage insurance.

Speak to CLS for more information.