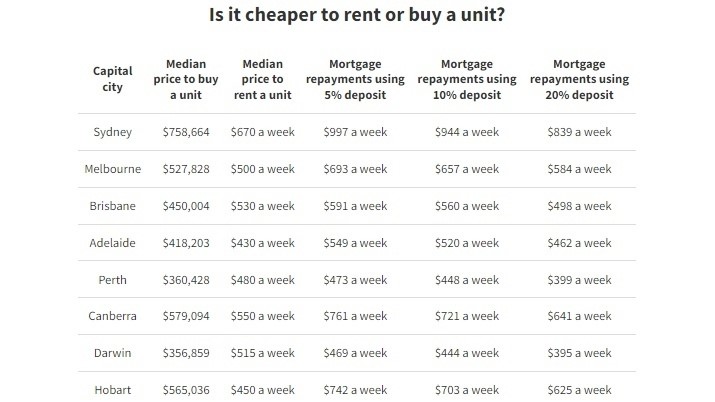

With unit rents soaring to record levels in most capital cities, it’s now cheaper for many people to buy rather than rent an apartment, according to Domain.

For residents of Brisbane, Perth and Darwin, it’s cheaper to pay a mortgage on the median-priced unit than to pay the city’s median unit rent. That assumes buyers put down a 20% deposit and take out a 30-year loan with a 6% interest rate.

In Adelaide, Canberra and Melbourne, buying costs only slightly more than renting.

In Sydney and Hobart, there’s a larger premium to buy. But those who do enter the market get to enjoy years of capital growth and the security that comes from owning your own home.

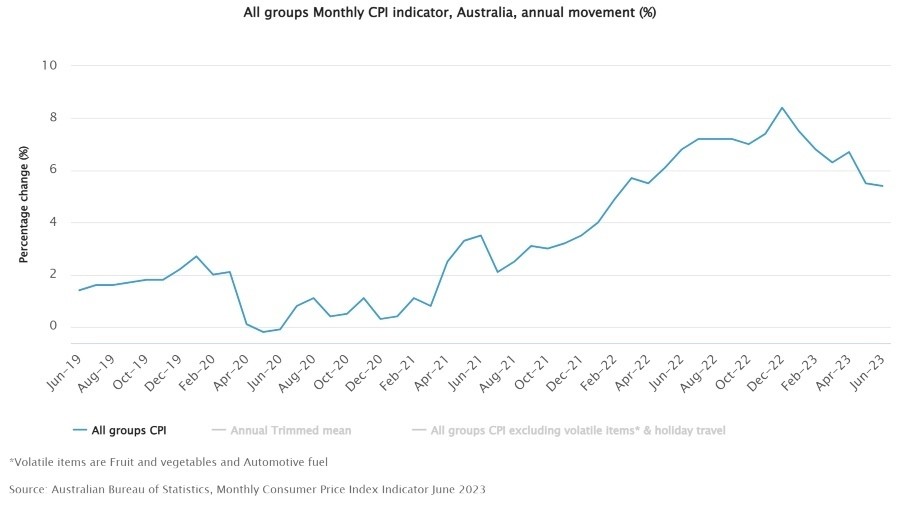

Inflation has fallen for the fifth time in six months, according to new data from the Australian Bureau of Statistics, but it’s unclear what this will mean for home loan interest rates.

Inflation peaked at 8.4% in December, and has now fallen from 5.5% in May to 5.4% in June.

The Reserve Bank will meet on Tuesday August 1 to decide whether to leave the cash rate on hold or increase it – which, in turn, would prompt lenders to increase their mortgage rates.

The reason the Reserve Bank has been increasing the cash rate for a year or so has been to reduce demand in the economy, and thereby drive down inflation to its target range of 2-3%.